- Companies

-

- Inventory

- Multi-currency for Purchasing

- Backorders

- Bay Locations

- Features

- Stock Tracking

- System Products

- Accounting details for Products

- Deactivating Products

- Products in Portal

- Suppliers

- Supplier Pricing

- Suppliers & Products

- Products

- Stock Transfers

- Barcodes

- Product Inventory Details

- Importing & exporting Product data

- Virtual Products

- Stock Adjustments

- Purchase Orders

- Enable or disable Stock-Tracking

- Training Products

- Units of Measure (UoM)

- Freight Products

- Working with Landed Costs

- Configuring Product Settings

- Stock Locations

- Stocktakes

- Product Batches

- Serial Numbers

- Different Price Types

- Purchase Orders

- Managing Stock

- Configurable Products

- Variable Products

- Time Billing

- Manufacturers and Suppliers

- FROM Location-based pricing

- TO Location-based pricing

- Requests For Quote

- Time Products

- Quantity-Based Price Breaks

- RFQ Web Templates

- PO Web Templates

- Location-based Price Breaks

- Customer-Specific Pricing

- Deleting Special Prices

Accounting details for Products

There is a range of accounting information stored in each of your Products in CRM. You can set default preferences for some of these at a system-level.

Also see:

- MYOB data sync settings

- Xero data sync settings

- Creating Products

- Product Settings

- Stock-tracked Products

Depending on how your items are configured, you will need to ensure you have supplied the required information in each of the following situations.

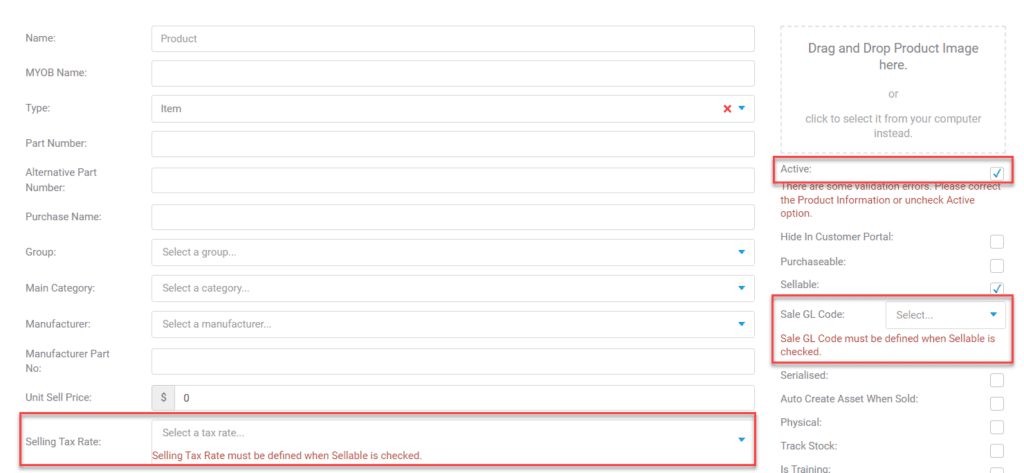

Configuring accounting details

Sellable Products

You must provide a Sale GL Code and Selling Tax Rate. The Active box should also be ticked.

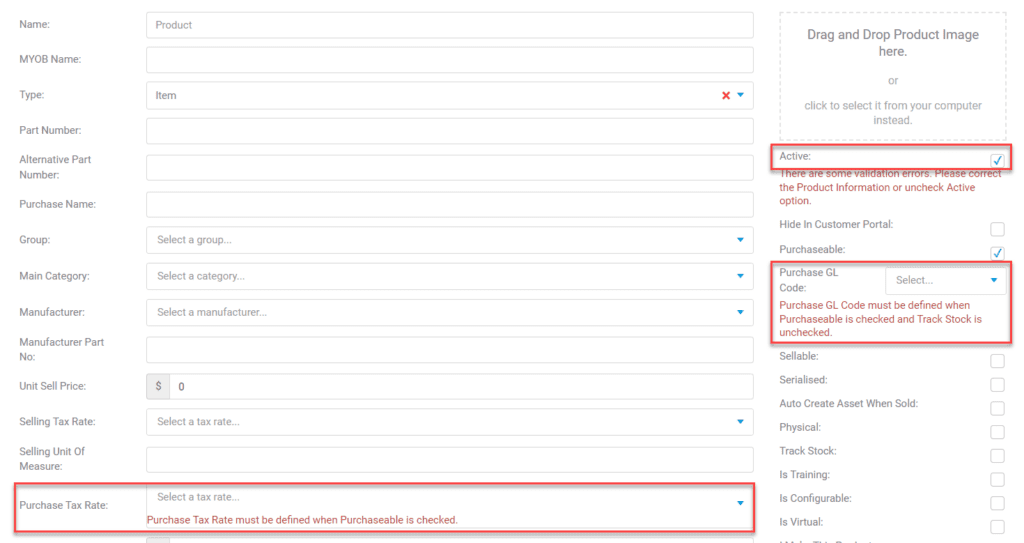

Purchasable Products

You must provide a Purchase GL Code and Purchase Tax Rate. The Active box should also be ticked.

Sellable & Purchasable Products

You must provide a Sale GL Code, Selling Tax Rate, Purchase GL Code and Purchase Tax Rate. The Active box should also be ticked.

Stock-Tracked Products

For more information, please see this guide.

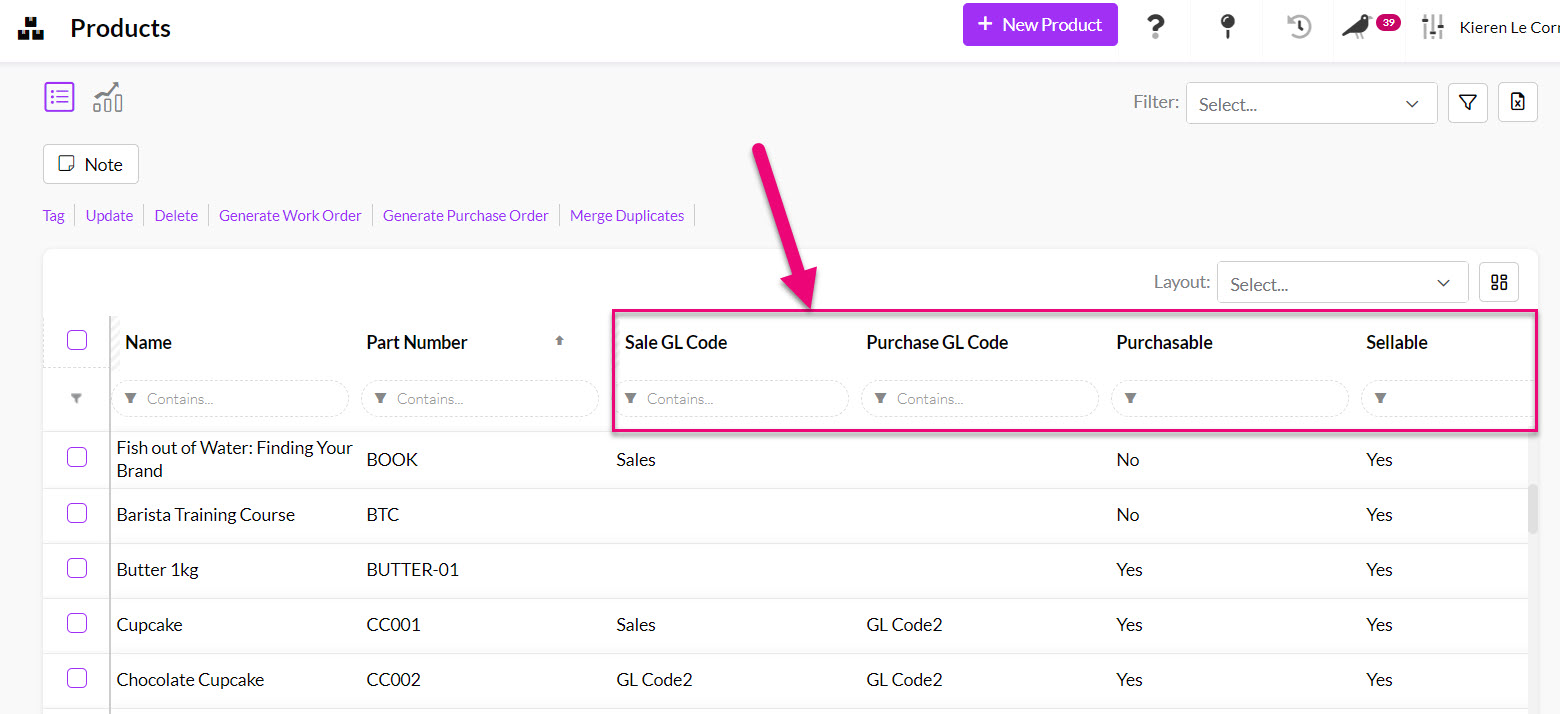

Updating accounting details in bulk

Using the column chooser in Products in grid view, you can quickly add columns (e.g. GL Code and/or Tax Rate) to your view, making it easy to see which fields are populated for which items, without having to check each item individually.

In the following example, I have added 4 columns:

- Purchase GL Code

- Purchasable

- Sale GL Code

- Sellable

Note that you can add any column/s available for selection, this is just an example.

From the screenshot you can see I have a big problem in that a lot of products I buy and sell don’t have a sale or purchase GL code applied to them.

I have 2 options to fix the issue:

- Bulk update the records to add the missing codes. This works well when there are small batches of records to update with a few fields.

- Export the data to Excel, add the codes and reimport it to CRM to update the items. This works well for large batches of records, or where a lot of fields need to be updated at once.

Products with accounting issues

There are 4 very useful columns you can add to the grid in Products:

- Accounting Code – if there is a value in this field, it means the record is synced with your accounting system, if it is empty, it is not synced.

- Accounting Import Date – the date the item was last imported from your accounting system.

- Accounting Export Date – the date the item was last exported to your accounting system.

- Accounting Error – if there is an issue syncing the record with your accounting system, it will be visible here.

The addition of these columns to your view or to a Layout mean it is easy to see these details at a glance, rather than needing to open each record individually.