Estimated Supplier Bills (ESB)

Receipting goods on a Purchase Order is handled by an Estimated Supplier Bill (ESB), which is a temporary bill. Most accountants commonly understand this as “stock that is received, but not billed”.

The ESB is designed to handle the problem that occurs when you create a purchase order to buy stock, even if you have receipted the goods into stock, you can’t sell the items until the supplier has given you the bill/invoice. Sometimes suppliers can take up to days/weeks to provide a bill for goods sold, so you end up with goods in stock that aren’t able to be sold.

How it works

CRM manages this issue as follows:

-

CRM sends out an ‘estimated’ Supplier Bill (ESB) to MYOB/Xero as a temporary record.

-

The ESB will sit in MYOB/Xero to allow for newly received stock to be invoiced.

-

Once a formal Supplier Bill has been received, it will then be added into CRM and exported to MYOB/Xero.

-

Once the Supplier Bill is in MYOB/Xero, the ESB will then be deleted automatically as if never there; it is a ‘transient’ record.

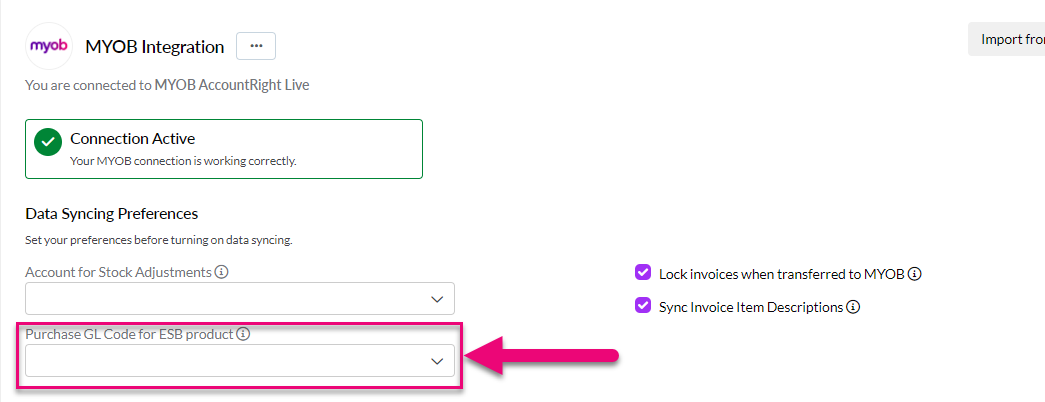

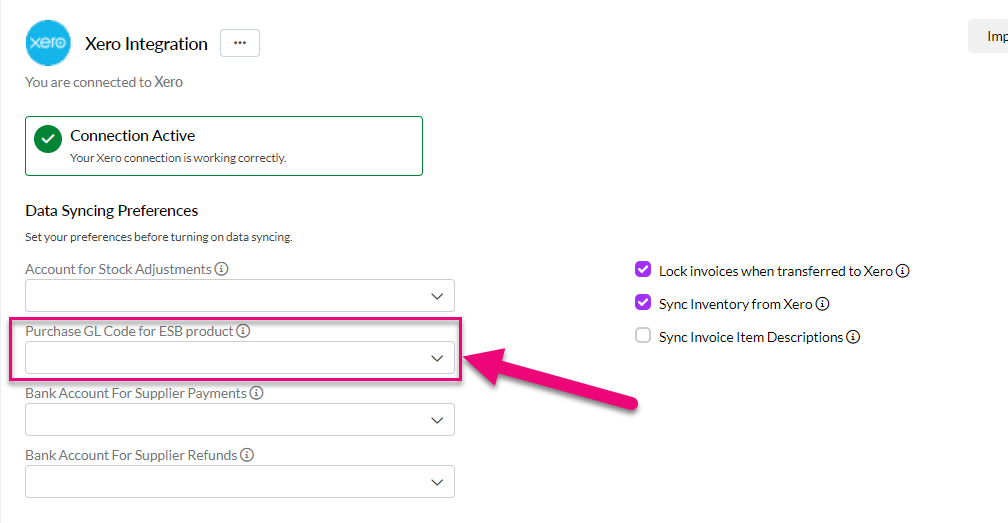

ESB settings

From Admin > Integrations in your accounting integration settings, you will need to ensure you have chosen a Purchase GL Code for ESB product. Until this field is filled in, you will receive an error when trying to sync purchases to your accounting system.

- The list of GL code options in this field will populate from your accounting system.

- If there are no GL codes available to select, you will need to create one in your accounting system.

You cannot choose a liability-type GL code here – the system will not allow it.

See also: